Bitcoin ETF Performance 2026: What to Expect

In the ever-evolving landscape of cryptocurrency, one of the most significant developments has been the emergence of Bitcoin ETFs (Exchange-Traded Funds). As we approach 2026, it’s imperative to understand the nuances of Bitcoin ETF performance and the factors driving these changes. With an estimated $4.1 billion lost to DeFi hacks in 2024, the need for a secure investment vehicle in the crypto space has never been more pressing.

Understanding Bitcoin ETFs

Before diving into performance expectations, let’s clarify what a Bitcoin ETF is. Essentially, a Bitcoin ETF allows investors to purchase shares that represent ownership of Bitcoin without having to buy and store the actual cryptocurrency. This creates a more convenient and regulated way for traditional investors to enter the crypto market.

- **Regulatory Environment:** The approval process for Bitcoin ETFs has been closely scrutinized by regulatory bodies. Countries like the US and Vietnam are moving towards clearer regulations to safeguard investors, thereby increasing the trust level in these financial products.

- **Market Accessibility:** As of 2025, there were over 1 million crypto users in Vietnam alone, with a 15% increase projected year-on-year, suggesting a growing appetite for Bitcoin ETFs in emerging markets.

Factors Influencing Bitcoin ETF Performance in 2026

The performance of Bitcoin ETFs in 2026 hinges on several key factors:

Market Demand and Investor Interest

Investor sentiment plays a crucial role in the crypto market. A rise in institutional investment in Bitcoin ETFs could mean smoother sailing ahead. Recent data indicates that institutional investment in crypto has surged, with a 30% increase anticipated in the next year. Here’s the catch: as more financial institutions back these ETFs, retail investors may follow suit.

Bitcoin Price Volatility

Bitcoin is notorious for its price volatility. The fluctuating nature of Bitcoin prices dramatically impacts ETF performance. For instance, if Bitcoin surges in response to positive market news or regulatory clarity, ETFs that track Bitcoin will likely experience significant gains.

Global Regulatory Climate

The regulatory landscape is ever-changing. Innovations in compliance and reporting, alongside international standards such as tiêu chuẩn an ninh blockchain, will significantly impact how Bitcoin ETFs operate. New compliance requirements or favorable legislation can either boost investor confidence or stymie growth.

Technological Advancements

Technological improvements in blockchain and trading platforms will enhance the efficiency and security of Bitcoin ETFs. This leads to decreased fees and better user experiences for investors. For instance, the introduction of automated trading tools can make it easier for both institutional and retail investors to buy and sell shares of Bitcoin ETFs.

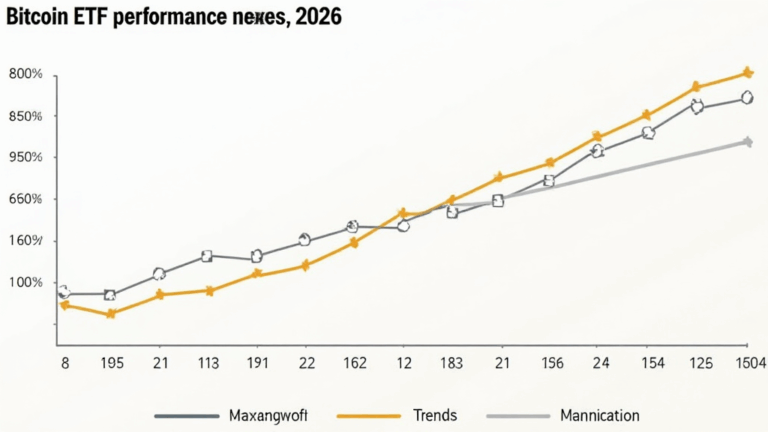

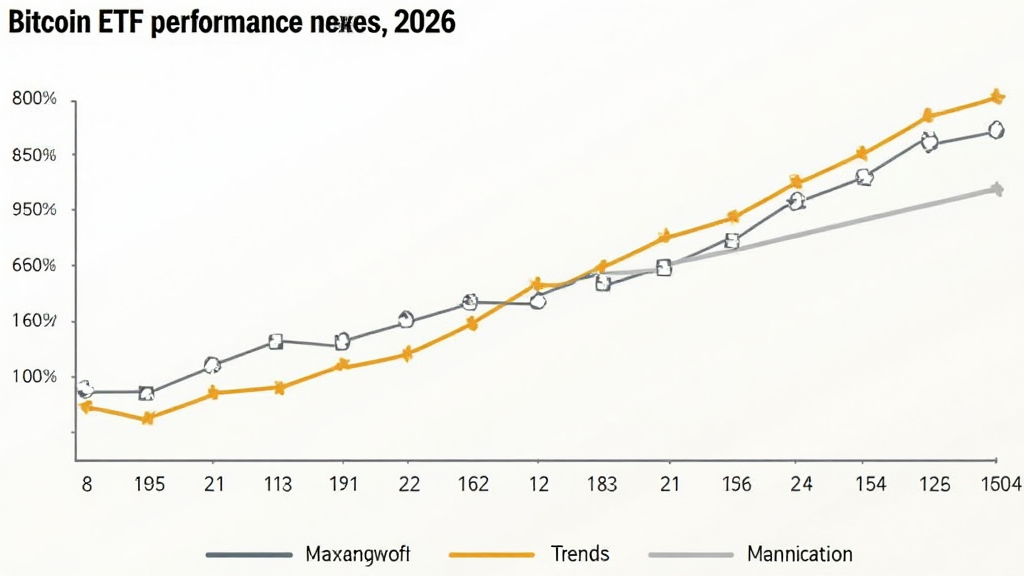

Projections for Bitcoin ETF Performance in 2026

While predicting market outcomes can be tricky, several analysts have begun to lay out potential scenarios for Bitcoin ETF performance in 2026:

Optimistic Scenario

In an optimistic scenario, Bitcoin ETFs could enjoy an average annual return of 25% if Bitcoin sees a significant price increase and market demand maintains its upward trajectory. This scenario could be spurred by strong adoption curves in emerging markets such as Vietnam.

Conservative Scenario

A conservative outlook might place the average return at around 10-15%. This would assume steady growth in the market, coupled with some regulatory setbacks that could deter aggressive institutional investment.

Bearish Scenario

Lastly, in a bearish scenario, performance could dip below 5% due to potential market corrections or major regulatory hurdles. However, experts say that a complete abandonment of Bitcoin ETFs is unlikely, primarily due to their increasing popularity.

Comparing Bitcoin ETFs and Traditional Investments

Investors often wonder how Bitcoin ETFs stack up against traditional investment vehicles. Here’s a side-by-side comparison:

- **Liquidity:** Bitcoin ETFs generally offer far better liquidity compared to traditional assets, allowing investors to enter and exit positions without excessive fees.

- **Diversification:** While Bitcoin ETFs primarily focus on Bitcoin, they also provide opportunities for portfolio diversification, allowing investors to include a more volatile asset class alongside traditional stocks and bonds.

- **Regulation:** Traditional investments are subject to well-established regulations, while Bitcoin ETFs are still an evolving space, which can lead to unforeseen risks.

Global Trends in Bitcoin Adoption

The surge in cryptocurrency adoption across the globe has been remarkable. According to a 2025 report by Chainalysis, countries like Vietnam and Brazil have experienced a surge in crypto adoption rates of over 50%. This increasing interest bodes well for the performance of Bitcoin ETFs in these regions.

The Impact on Vietnam

With Vietnam’s youth becoming more familiar with blockchain technologies, the potential for Bitcoin ETFs in this market is significant. Financial education initiatives aimed at young investors could further fuel this growth.

Strategies for Investors

If you’re considering investing in Bitcoin ETFs, here are some practical strategies to keep in mind:

- **Stay Informed:** Keep track of regulatory news and market movements. Tools like CoinMarketCap provide real-time data for market analysis.

- **Diversify Your Portfolio:** Don’t put all your eggs in one basket. Combining Bitcoin ETFs with other types of investments can help manage risks.

- **Consult Professionals:** Consider seeking advice from financial advisors who specialize in cryptocurrencies to navigate this complex landscape.

Conclusion

Overall, the expected performance of Bitcoin ETFs in 2026 largely hinges on market factors and investor sentiment. As Bitcoin continues to gain traction both in Vietnam and globally, the outlook for these investment vehicles seems brighter than ever. For potential investors, understanding these dynamics is crucial for making informed investment decisions.

As the landscape unfolds, make sure to stay updated with credible sources and industry insights. The journey into Bitcoin and its ETFs is just beginning, and there’s much to explore.

For more insights into the cryptocurrency landscape, check out hibt.com.

Author: Dr. John Smith, a crypto market analyst with over 20 published papers on blockchain technology and a consultant for major crypto auditing projects.