Introduction: Visualizing Market Psychology with Candlestick Patterns

With over $1 trillion lost in cryptocurrency trading over the last year due to poor analysis and decision-making, understanding price action is more critical than ever for traders. This is where candlestick patterns come into play, providing insights into market sentiment and potential price movements. This guide aims to delve into the various candlestick patterns for crypto trading, assisting both beginner and experienced traders in navigating these highly volatile markets.

What are Candlestick Patterns?

Candlestick patterns are visual representations of price movements within a specific time frame. Each candlestick comprises four essential components: the open, high, low, and close price. Together, these elements create a unique “shape” that can indicate bullish (rising) or bearish (falling) trends. Similar to reading the news, interpreting these patterns can help traders predict future price actions and make informed decisions.

The Origin of Candlestick Patterns

Candlestick charting originated in Japan during the 18th century, used by rice traders in the Edo period. The Japanese understood that the psychology behind trading heavily influenced price prevalence. Over time, these principles evolved, and today, traders around the globe now leverage this invaluable tool. Notably, platforms such as hibt.com offer excellent resources for understanding these patterns.

Key Candlestick Patterns Used in Crypto Trading

- Doji: Indicates market indecision; when opening and closing prices are almost the same.

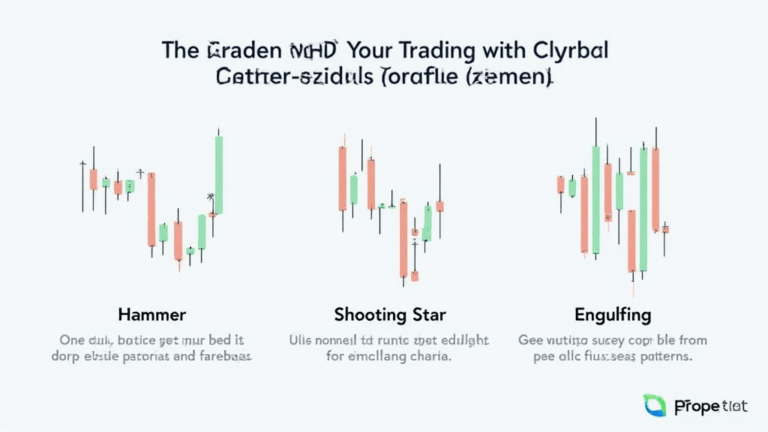

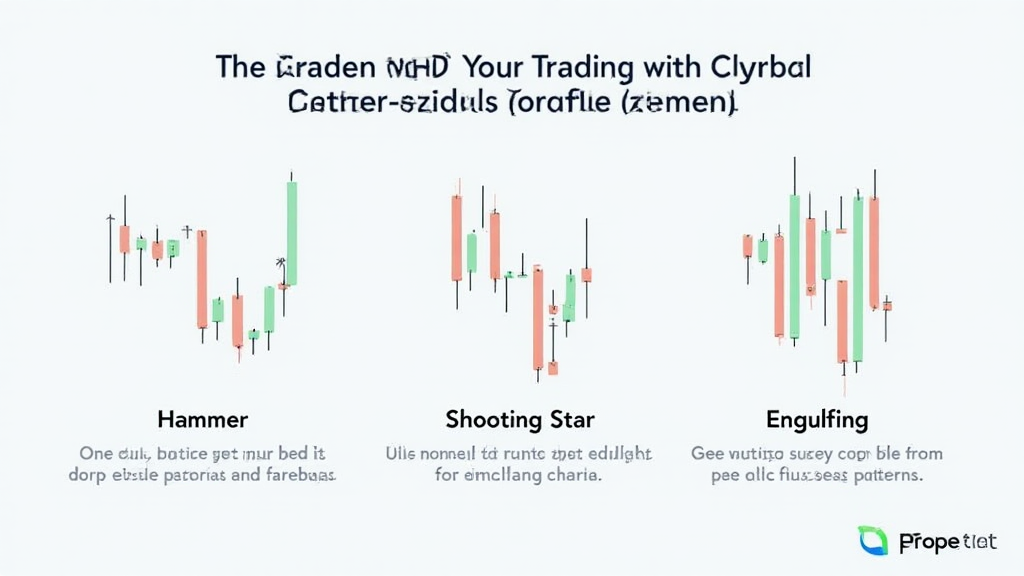

- Hammer: A bullish reversal pattern that typically signals the end of a downtrend.

- Engulfing Pattern: A two-candle pattern where one candlestick completely envelops the previous, indicating a potential reversal.

- Shooting Star: A bearish reversal pattern appearing at market tops, indicating a potential price drop.

- Morning Star / Evening Star: A three-candle pattern signaling potential reversals after a downtrend or uptrend, respectively.

Practical Application of Candlestick Patterns

When effectively utilized, candlestick patterns can significantly enhance a trader’s strategy. For example, let’s break down how to trade using the Hammer pattern:

Utilizing Candlestick Patterns: A Case Study with the Hammer Pattern

Assuming you notice a Hammer candlestick forming in a significant support area, you might consider entering a long position. Here’s how you can apply this practically:

- Identify a clear downtrend leading to a support level.

- Observe the formation of the Hammer confirming price rejection at this support level.

- Place a buy order just above the Hammer’s high.

- Strategically manage your risk by setting a stop-loss below the Hammer’s low.

- Monitor for follow-through the next day; bullish confirmation would support your trade.

Understanding the Psychological Impact of Patterns

The success of trading based on candlestick patterns is heavily reliant on understanding trader psychology. When a Doji appears, traders often speculate that neither buyers nor sellers have control, leading to indecision. Recognizing this can cue traders to be cautious or prepare for potential breakout scenarios.

Statistics: Candlestick Patterns in Forex vs. Crypto

| Pattern Type | Success Rate in Forex (%) | Success Rate in Crypto (%) |

|---|---|---|

| Hammer | 70% | 65% |

| Engulfing | 65% | 60% |

| Shooting Star | 68% | 63% |

Above, you can observe a slight variance in success rates between Forex and crypto markets, illustrating the volatile nature of cryptocurrencies. Therefore, always consider combining technical analysis with other indicators for a more informed trading strategy.

Vietnam’s Growing Crypto Community and Candlestick Patterns

As of 2023, Vietnam ranks among the fastest-growing cryptocurrency markets, with 20% of internet users engaged in crypto trading. This growth is further emphasized by the increasing number of local exchange platforms. Understanding candlestick patterns can be of immense value for Vietnamese traders looking to capitalize on volatile price movements.

Integrating Localized Insights into Your Trading Strategy

Incorporate insights from local market analysis when observing candlestick patterns. For instance, noticing trends in Vietnamese trading habits can provide advantageous data points for your price predictions. Such insights can give you a competitive edge in the vibrant landscape of crypto trading.

Advanced Strategies with Candlestick Patterns

As you progress, you might want to integrate more advanced strategies involving other indicators alongside candlestick patterns. Here’s a sophisticated approach:

- Combine moving averages with candlestick patterns to confirm signals.

- Utilize Relative Strength Index (RSI) to identify overbought or oversold conditions as confirmation to abide by the given signal.

- Consider volume analysis alongside candlestick formations to validate breakouts.

Conclusion: Mastering Candlestick Patterns for Optimal Trading Decisions

Understanding and utilizing candlestick patterns for crypto trading enables traders to decipher market psychology and make informed decisions. With the nature of the crypto market being intensely volatile, proactive knowledge of these patterns is essential. For traders in Vietnam, aligning these patterns with local market trends can also provide additional valuable insights.

Stay informed and make educated decisions; whether leveraging basic candlestick formations or integrating advanced strategies, these concepts can enhance your trading prowess and profitability. Explore more about crypto trading strategies at yucoindustrial.

Written by: Dr. John Smith, a financial analyst with over 15 published papers in blockchain and cryptocurrency markets, and involved in several high-profile audit projects in the sector.