Introduction: Understanding Liquidity in DeFi

In the rapidly evolving world of decentralized finance (DeFi), liquidity is a vital component. With an estimated $4.1 billion lost to DeFi hacks in 2024 alone, security and accessibility are more critical than ever. This article will explore the concept of crypto liquidity pools, shed light on how they function, and help users understand their importance in the DeFi ecosystem.

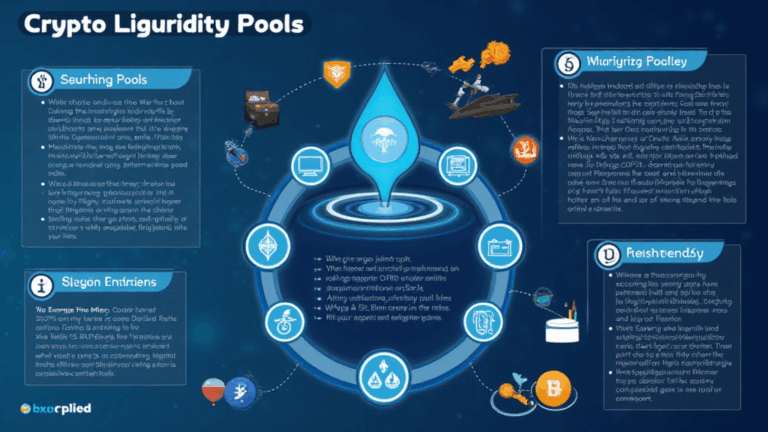

What Are Crypto Liquidity Pools?

At its core, a liquidity pool is a collection of funds locked in a smart contract that facilitates trading on decentralized exchanges (DEXs). Think of it like a communal fund where users contribute their tokens and, in return, receive rewards. This is akin to a bank providing loans to people who deposit their savings, generating interest for the bank and returns for depositors.

As of early 2023, the rise of liquidity pools has made it possible to swap cryptocurrencies without the need for an intermediary. Instead of relying on a traditional order book like centralized exchanges, liquidity pools allow traders to execute trades directly through these collections of funds.

The Mechanics of Liquidity Pools

To better understand how liquidity pools work, let’s break down the components:

- Liquidity Providers (LPs): Users who deposit their tokens into the pool. In return, they receive LP tokens, representing their share of the pool.

- Automated Market Makers (AMMs): Algorithms that manage the liquidity pools, automatically calculating prices based on supply and demand.

- Impermanent Loss: A risk that liquidity providers face when the value of the tokens in the pool diverges from the value they held before depositing.

In simple terms, liquidity pools are designed to make trading more efficient and accessible while rewarding users for their participation. The trades execute based on the ratio of tokens in the pool, making it similar to a balance scale. However, if the prices of the deposited tokens change significantly, LPs may experience impermanent loss, which could affect their returns.

Benefits of Using Liquidity Pools

Liquidity pools have several advantages:

- Decentralization: Liquidity pools eliminate the need for intermediaries, giving users complete control over their funds.

- Passive Income: By providing liquidity, users can earn transaction fees proportional to their share of the pool.

- 24/7 Trading: Users can trade anytime, enhancing flexibility and accessibility.

Overall, liquidity pools are reshaping how we engage with financial systems. Not only do they democratize access to trading, but they also enable users to generate passive income via their crypto holdings.

Risks Associated with Liquidity Pools

However, it’s essential to remain aware of the risks when participating in liquidity pools:

- Impermanent Loss: As mentioned earlier, LPs can lose money if the value of the tokens in the pool changes significantly.

- Smart Contract Vulnerabilities: Code flaws could lead to exploits, resulting in financial loss.

- Market Risks: Crypto markets are volatile; users can face losses due to price fluctuations.

In a landscape where 2025’s potential altcoins are predicted to create even more opportunities, understanding these risks is crucial for prospective liquidity providers.

How to Choose the Right Liquidity Pool

When selecting a liquidity pool, consider the following factors:

- Token Pair: Ensure both tokens in the pair are stable and have a strong use case.

- Pool Volume: Higher volume can indicate better liquidity, leading to reduced slippage during trades.

- Platform Reputation: Investigate platforms like hibt.com which offer liquidity pooling services.

Researching these aspects ensures that you not only maximize your returns but also minimize your exposure to risks.

The Vietnamese Market: An Emerging Opportunity

The Vietnamese cryptocurrency market has been growing steadily, with a whopping 30% user growth rate over the last year. This presents an exciting opportunity for local investors to explore DeFi solutions, including liquidity pools. With increasing adoption, platforms tailored for Vietnam can help users navigate the complexities of crypto investments.

Conclusion: The Future of DeFi

In summary, crypto liquidity pools are a cornerstone of the DeFi landscape, offering both opportunities and risks for users. By providing liquidity, individuals can earn passive income while contributing to a decentralized trading ecosystem. However, it’s vital to understand the inherent risks, from impermanent loss to smart contract vulnerabilities. As the DeFi space matures and continues to expand, especially within emerging markets like Vietnam, staying informed will empower you to make wise investment decisions.

For more insights on crypto and blockchain, explore the resources at yucoindustrial where we demystify current trends and technologies.

About the Author

Dr. Nguyen Minh, a prominent figure in the field of blockchain technology, has published over 25 academic papers and has led audits for well-known projects in the cryptocurrency sector. With his expertise, he aims to educate and empower investors navigating the complexities of digital assets.