Crypto Remittances in Southeast Asia: The Future of Digital Finance

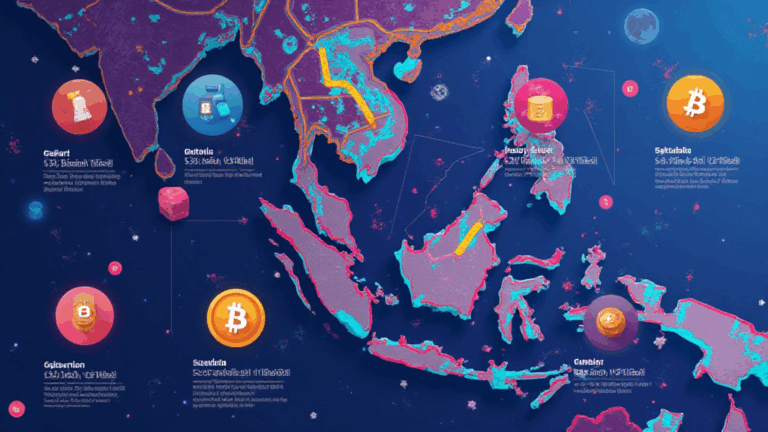

As digital currencies continue to rise in adoption and applicability, the landscape of financial transactions is evolving, particularly in regions like Southeast Asia. In 2024 alone, it was reported that $5 billion was transferred using crypto remittances across Southeast Asia, demonstrating a significant shift in how monetary transactions occur. This article aims to explore the benefits and challenges of crypto remittances in Southeast Asia, supported by current data and insights.

Understanding Crypto Remittances

Before diving deeper into the specifics of Southeast Asia, let’s first clarify what crypto remittances mean. Simply put, crypto remittances involve transferring digital currencies from one party to another, typically across borders, as a means of sending money to relatives or friends. This method offers advantages over traditional remittance options, such as lower fees and faster transaction times.

Key Benefits of Crypto Remittances

- Lower Transaction Fees: Traditional remittance services can charge fees ranging from 5% to 10%. In contrast, using cryptocurrencies can reduce these fees significantly, sometimes to below 1%.

- Speed: Many crypto transactions are completed within minutes, whereas traditional remittance methods may take days to process.

- Accessibility: With growing smartphone penetration in Southeast Asia, virtually anyone can access a cryptocurrency wallet, making financial transactions more inclusive.

The Growing Adoption of Crypto in Southeast Asia

According to the latest data from HIBT, Southeast Asia is one of the fastest-growing regions for cryptocurrency adoption, driven largely by a young population and increasing digital literacy. For instance, it was reported that over 30% of the Southeast Asian population surveyed indicated they would be comfortable using cryptocurrencies. This trend is especially pronounced in countries like Vietnam, Thailand, and the Philippines.

Vietnam: A Driving Force

Particularly notable is Vietnam, where the growth rate of cryptocurrency users hit 200% in 2023. This increase can be credited to several factors, including economic challenges and the popularity of peer-to-peer (P2P) trading platforms.

In Vietnam, many individuals are transitioning from traditional currencies to digital assets, leading to an environment ripe for crypto remittances. tiêu chuẩn an ninh blockchain (security standards in blockchain) are also being evaluated and adopted, ensuring users feel secure in their transactions.

Challenges Facing Crypto Remittances

Despite the numerous benefits, there are several challenges associated with crypto remittances. These challenges must be navigated to ensure continued growth and acceptance.

Regulatory Concerns

The regulatory landscape for cryptocurrencies throughout Southeast Asia varies greatly from country to country. In some nations, regulations are still being developed, leading to uncertainty. For others, such as the Philippines, guidelines are being established, yet issues remain regarding compliance and user protection.

Volatility of Cryptocurrencies

Cryptocurrencies are known for their price volatility, and this can pose risks when sending remittances. Users may experience significant value loss within short time frames, creating uncertainty in transactions. However, the continuous development of stablecoins offers some hope for mitigating this issue.

Future of Crypto Remittances in Southeast Asia

As we examine the trends and data, it’s evident that the future of crypto remittances in Southeast Asia is bright. The sector is poised for growth, but several areas should be focused on:

Education and Awareness

One of the primary keys to success is enhancing the public’s understanding of cryptocurrencies. Organizations and local advocates must work together to educate users on how to safely and effectively utilize crypto for remittances.

Technological Developments

In addition, continuous innovation within blockchain technology, including smart contracts, will facilitate even smoother and safer remittance processes. For those interested in the future of cryptocurrency systems, learning how to audit smart contracts may become increasingly valuable.

Conclusion

In summary, the crypto remittance sector in Southeast Asia is rapidly evolving, offering immense opportunities for individuals wanting to send money across borders with reduced costs and enhanced speed. It’s essential to stay informed, as the dynamics of this space will continue to change.

As we look ahead to 2025 and beyond, it is vital to understand the ongoing developments in crypto remittances. Join the revolution in digital finance with platforms like yucoindustrial.

Author: Dr. Minh Pham, a recognized authority with numerous publications in blockchain technology and has led significant projects in smart contract auditing.