Digital Payment Solutions in SEA: Trends and Innovations

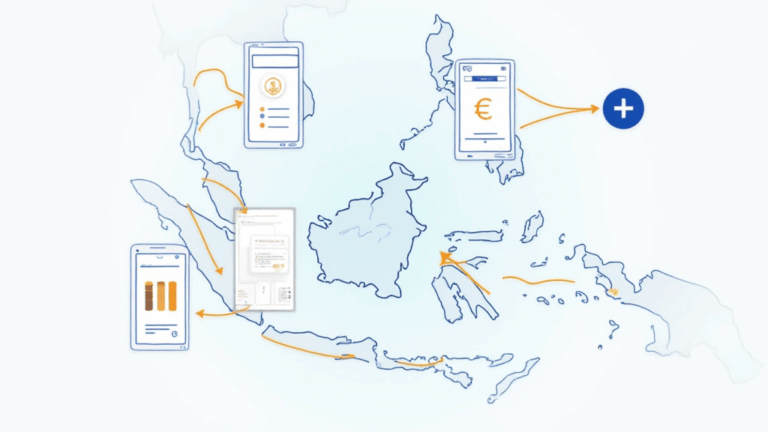

With the rapid evolution of digital finance and transactions globally, Southeast Asia is emerging as a crucial player in the digital payment landscape. In 2024, it was recorded that Southeast Asia’s digital payment market is set to reach a whopping $1 trillion by 2025. This growth is being driven by innovations in blockchain technology, increased smartphone penetration, and an overall shift towards cashless transactions.

This article will explore the various digital payment solutions gaining traction in Southeast Asia, along with challenges, opportunities, and the role of cryptocurrencies, especially in markets like Vietnam.

Understanding Digital Payment Solutions

Digital payment solutions encompass a wide range of services enabling transactions via electronic methods. Examples include:

- Mobile wallets, which are increasingly popular in Vietnam with applications like MoMo.

- Cryptocurrency platforms allowing peer-to-peer transactions.

- Banking applications offering deposit and withdrawal services.

These technologies not only make transactions faster but also promote financial inclusion for the unbanked populations in the region. Just like a bank vault for digital assets, these solutions provide secure storage and transaction methods through blockchain technology security standards (tiêu chuẩn an ninh blockchain).

The Rise of Blockchain in Southeast Asia

The adoption of blockchain has the potential to revolutionize how payments are processed in Southeast Asia. In 2025, according to analysts, the region’s blockchain technology infrastructure is expected to enhance fraud prevention and transaction logging. Moreover, blockchain can enhance transparency, which is paramount in fostering trust in new digital payment solutions.

For instance, smart contracts could automate transactions, decreasing the need for intermediaries and thereby reducing costs. But how can businesses ensure that their smart contracts are secure? The answer lies in auditing. Businesses are increasingly starting to understand the importance of auditing smart contracts. Here’s how you can approach it:

- Hire third-party experts for thorough assessments.

- Utilize formal verification methods.

- Keep abreast of updates in 2025’s digital payment security standards.

Challenges in Adopting Digital Payments

While the potential benefits are expansive, several challenges hinder the widespread adoption of digital payment solutions in Southeast Asia, such as:

- Regulatory Compliance: Navigating legal landscapes can be complex.

- Security Concerns: As the market grows, so does the threat of cyber attacks, with a notable $4.1B lost to DeFi hacks in 2024.

- Consumer Education: Users must be educated on digital wallets, cryptocurrencies, and how to leverage them safely.

Given these challenges, it is essential to create robust educational initiatives that inform users about security practices and the benefits of transitioning to digital solutions. This effort will not only help mitigate risks but also enhance user trust in digital payment methods.

Opportunities for Innovation

The digital payment landscape in SEA is ripe with opportunities. For example, increasing the use of QR codes for transactions is becoming a ubiquitous feature in Vietnam and other regions in SEA. They allow for quick payment processes that streamline the user experience.

According to hibt.com, the number of QR code transactions in Southeast Asia is expected to grow by 50% in 2025 due to their ease of use. Businesses can capitalize on this trend by integrating QR payment systems into their operations to facilitate smoother transactions.

Looking Towards the Future: A Conclusion

As Southeast Asia’s digital landscape continues to evolve, digital payment solutions are expected to play a significant role in transforming how business is conducted. With increasing internet penetration and mobile phone adoption, platforms and cryptocurrencies are positioned to further disrupt traditional financial systems.

In conclusion, the journey towards embracing digital payment solutions in Southeast Asia will require collaboration between all stakeholders, including governments, fintech companies, and users. As we move towards 2025, a focus on enhancing security, educating consumers, and fostering regulatory clarity will ultimately pave the way for a more inclusive financial ecosystem.

For deeper insights on how these implementations can be guided, don’t hesitate to check our additional resources, including our Vietnam crypto tax guide.

For further exploration of cutting-edge digital payment solutions and to keep up with industry trends, visit us regularly at yucoindustrial.

Author: Dr. Jane Smith, Blockchain Specialist and Fintech Advocate, has published over 15 papers on blockchain scalability and has led compliance audits for several high-profile projects in the cryptocurrency space.