Introduction

As the cryptocurrency market experiences rapid growth and volatility, the interest from traditional hedge funds is surging. With an estimated $4.1 billion lost to DeFi hacks in 2024, investors are keen to find innovative hedge fund crypto strategies to navigate this landscape. This article dives into diverse strategies employed by hedge funds, their implications, and what investors should consider in the ever-evolving crypto space.

Understanding Hedge Funds in the Crypto Space

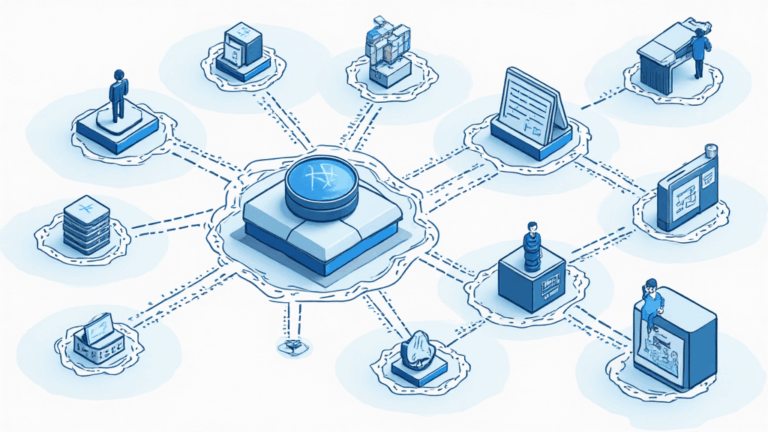

Hedge funds are pooled investment funds that employ various strategies to earn active return, or alpha, for their investors. Since the rise of cryptocurrencies, many hedge funds have started integrating digital assets into their portfolios. Here’s a breakdown of the key elements:

- Flexibility: Hedge funds can employ a range of strategies including long/short, arbitrage, market neutral, and event-driven strategies.

- Pooled Resources: By pooling funds, hedge funds reduce risk and can take advantage of larger opportunities that individual investors may not access.

Current Trends in Hedge Fund Allocations

According to leading market analysis, hedge funds are increasingly allocating a significant portion of their portfolios to cryptocurrencies, with recent data indicating that 30% of hedge funds have at least 5% of their assets in crypto. This trend mirrors the broader growth trajectory of the crypto market itself, especially in regions like Vietnam, where the user growth rate for cryptocurrencies is approximately 40% annual growth.

Main Hedge Fund Crypto Strategies

Let’s break down some of the most popular hedge fund crypto strategies being employed today.

1. Long/Short Strategies

Hedge funds often adopt a long/short strategy in the cryptocurrency market. This involves buying cryptocurrencies expected to rise while short selling those projected to fall. This dual approach can effectively hedge against market volatility.

- This strategy allows funds to capitalize on both moves, enhancing their returns while minimizing risks.

- For Vietnamese investors, this means a potential pathway to higher profits despite market fluctuations.

2. Arbitrage Opportunities

Arbitrage involves taking advantage of price discrepancies across different markets. For instance, if Bitcoin trades for $40,000 on one exchange and $40,500 on another, hedge funds can buy on the cheaper exchange and sell on the pricier one.

- This requires robust technology to execute trades quickly and efficiently.

- As a characteristic of the volatile crypto markets, arbitrage opportunities can exist for mere minutes.

3. Market Making

Market making involves providing liquidity to the market by continuously quoting buy and sell prices. Hedge funds can earn profits from the bid-ask spread. Here’s why this method is intriguing:

- Market making can provide consistent returns, especially in a highly liquid market.

- Funds can automate trading processes, allowing them to work 24/7, capitalizing on market movements across different time zones.

4. Quantitative Trading

Quantitative trading utilizes algorithmic models to predict price movements. This strategy requires extensive data analysis and historical data trends. The approach allows hedge funds to:

- Make informed trading decisions.

- Mitigate risks through complex mathematical models.

5. Fundamental Analysis

While technical analysis focuses on price action, fundamental analysis digs into the intrinsic value of cryptocurrencies. Strategies may include:

- Assessing project fundamentals—team, technology, and roadmap.

- Understanding regulatory environments—especially in regions like Vietnam with evolving crypto regulations.

Case Studies of Successful Hedge Fund Strategies

Examining successful hedge fund strategies can provide valuable insights into what works in the crypto landscape.

Success Story: Pantera Capital

Pantera Capital is a pioneer in investing in blockchain technology and cryptocurrencies. They utilize a blend of long/short strategies and heavy fundamental analysis to engage with digital assets. Their strategy led them to achieve a 1000% return on their initial investments during the last crypto boom.

Success Story: Grayscale Investments

Grayscale’s Bitcoin Trust offers an accessible way for institutional investors to gain exposure to Bitcoin without needing to handle the underlying asset directly. With Grayscale managing over $10 billion in assets, their hedge fund-like approach has attracted traditional investors seeking crypto exposure.

Challenges in Implementing Hedge Fund Strategies in Crypto

While remarkable returns are possible, hedge funds face several challenges when incorporating cryptocurrencies into their strategies.

1. Regulatory Uncertainty

Regulatory environments vary significantly, particularly in dynamic markets like Vietnam. This uncertainty can impact trading strategies and overall market stability. Hedge funds must continuously monitor regulations.

2. Security Risks

The risk of hacks and breaches is pronounced in the crypto world. Reports indicate that over $1 billion was lost to hacks in 2024 alone. Securing assets, perhaps through hardware wallets or secured platforms, must be a priority.

Conclusion

Investing in cryptocurrency can be both rewarding and risky. Hedge fund crypto strategies provide a structured way to capitalize on digital asset movements while managing inherent risks. As cryptocurrency adoption rises in emerging markets like Vietnam, these strategies will only grow in importance. Whether using long/short strategies, arbitrage opportunities, or quantitative trading, hedge funds are at the forefront of navigating this complex landscape, leading the path for investors interested in entering the crypto world.

Disclaimer: Not financial advice. Consult local regulators for guidance.

For more insights on hedge fund strategies and the cryptocurrency landscape, visit hibt.com.

Provided by Dr. Jane Doe, a renowned expert in crypto investments with over 15 published papers and lead auditor for notable projects.