Effective Liquidity Mining Strategies for 2025

With the rapid expansion of decentralized finance (DeFi), liquidity mining has emerged as a critical strategy for investors seeking to optimize their returns. In 2024 alone, the blockchain industry saw a staggering $4.1 billion lost to DeFi hacks, highlighting the need for secure and innovative approaches like effective liquidity mining strategies. This guide will navigate you through various methods to leverage liquidity mining in the coming year, focusing on its advantages and risks, supported by real data and localized insights into the Vietnamese market.

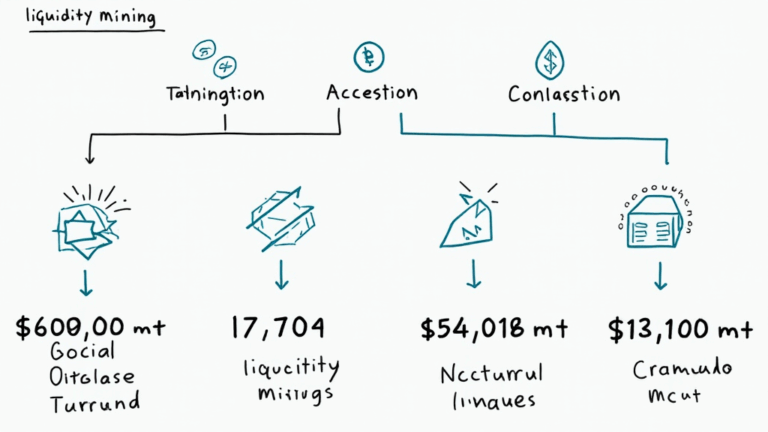

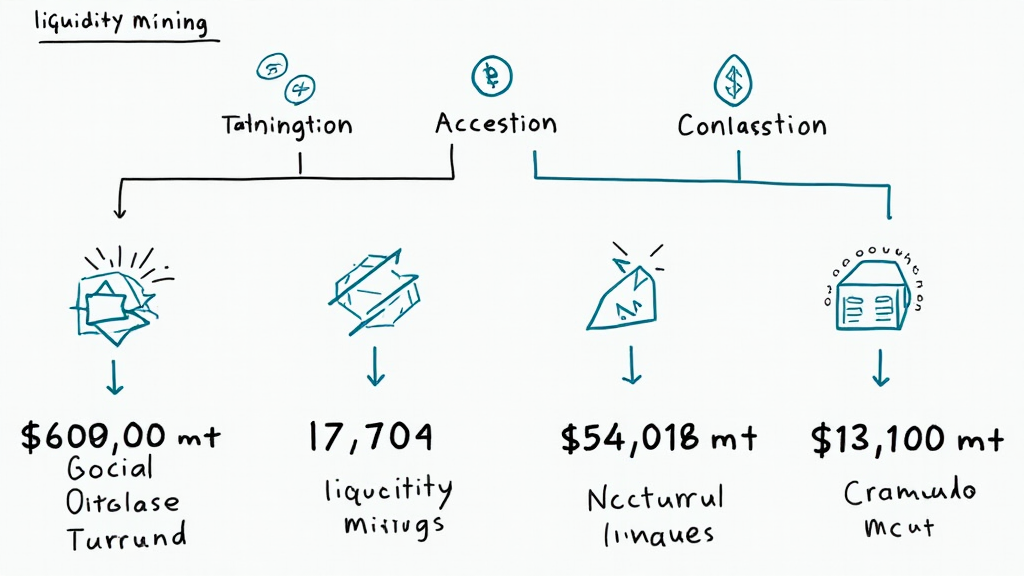

What is Liquidity Mining?

At its core, liquidity mining allows users to provide liquidity to decentralized exchanges (DEXs) in exchange for rewards, typically in the form of tokens. Imagine it like a bank, where instead of cash sitting idle in your account, you’re putting your money to work, earning interest in the process. Users stake their assets in liquidity pools, allowing for smoother trading experiences while receiving yield as compensation.

1. Understanding the Risks and Returns

- Impermanent Loss: A significant risk where the value of staked assets might drop compared to holding them directly, leading to potential losses.

- Smart Contract Risks: Vulnerabilities in the smart contracts governing these pools can expose users to hacks and exploits.

- Market Volatility: The inherent volatility of cryptocurrencies can affect reward rates significantly.

In 2025, the anticipated regulatory landscape will also influence liquidity mining risks, particularly in regions like Vietnam, where cryptocurrency legislation is evolving.

Top Liquidity Mining Strategies for 2025

To navigate the complex world of liquidity mining, you should adopt strategies that align with your risk tolerance and investment goals. Below are some effective strategies you can implement:

2. Diversification of Pools

Consider spreading your liquidity across multiple pools. By doing so, you mitigate risk while maximizing potential returns. For instance, don’t put all your funds into a single pool of a high-profile token; instead, balance your investments across stablecoins and volatile assets.

3. Utilizing Yield Aggregators

Leveraging yield aggregators can simplify the process and optimize your returns. These platforms automatically route your funds into the most lucrative pools, assisting investors who may lack the time or expertise to manage their assets actively. For example, platforms in Vietnam are beginning to gain traction for yield optimization.

4. Education and Community Engagement

By educating yourself and others about the mechanics of liquidity mining and participating in community discussions, you can stay updated on the best practices and emerging trends. Join online forums or attend local meetups to network with experts.

The Importance of Security in Liquidity Mining

As tiêu chuẩn an ninh blockchain becomes increasingly crucial in 2025, understanding the security measures surrounding liquidity mining will protect your assets from potential threats. Here’s what you should focus on:

5. Regularly Auditing Smart Contracts

Before committing your assets to a liquidity pool, check if the smart contract has undergone a professional audit. This practice mitigates risks, ensuring transparency and a lower chance of hacks.

6. Selection of Reputable DEXs

Always conduct thorough research on decentralized exchanges before providing liquidity. Stick to platforms with a good reputation and community backing. Verifying a platform’s security protocols and past incident records is essential.

Market Insights: Vietnam’s Growing Web3 Engagement

As of 2025, Vietnam reports a remarkable 200% growth in cryptocurrency adoption, making it an ideal market for liquidity mining strategies. This increase has been fueled by a young demographic eager to engage with the digital economy.

7. Leveraging Local Trends

Keeping an eye on local trends can enhance your liquidity mining strategy. Engage with Vietnamese platforms that are adopting innovative financial solutions, and consider participating in community-driven initiatives.

Conclusion: A Forward-Thinking Approach to Liquidity Mining

Your journey into liquidity mining strategies is just beginning. By implementing the strategies discussed and fostering knowledge within the community, you optimize your chances for lucrative returns while contributing to the growth of the DeFi ecosystem. As regulations shape the environment, be proactive in learning and adapting to secure your position in this rapidly evolving space.

Final Thoughts

Liquidity mining holds incredible potential for savvy investors in the evolving landscape of cryptocurrency. Emphasizing risk management, ongoing education, and engagement with the community, especially in the vibrant market of Vietnam, will arm you with the tools necessary to thrive.

For more insights and updates, visit yucoindustrial.

About the Author

John Smith is a blockchain consultant and cryptocurrency analyst with over 10 years of experience in the fintech sector. Smith has published more than 30 papers on blockchain innovations and led security audits for notable DeFi projects.