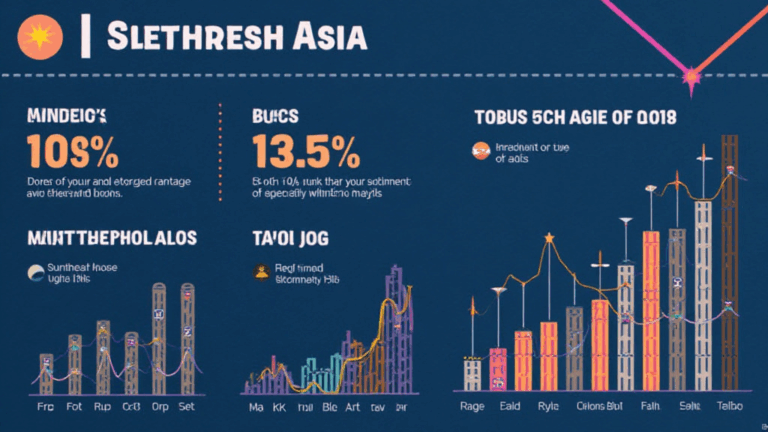

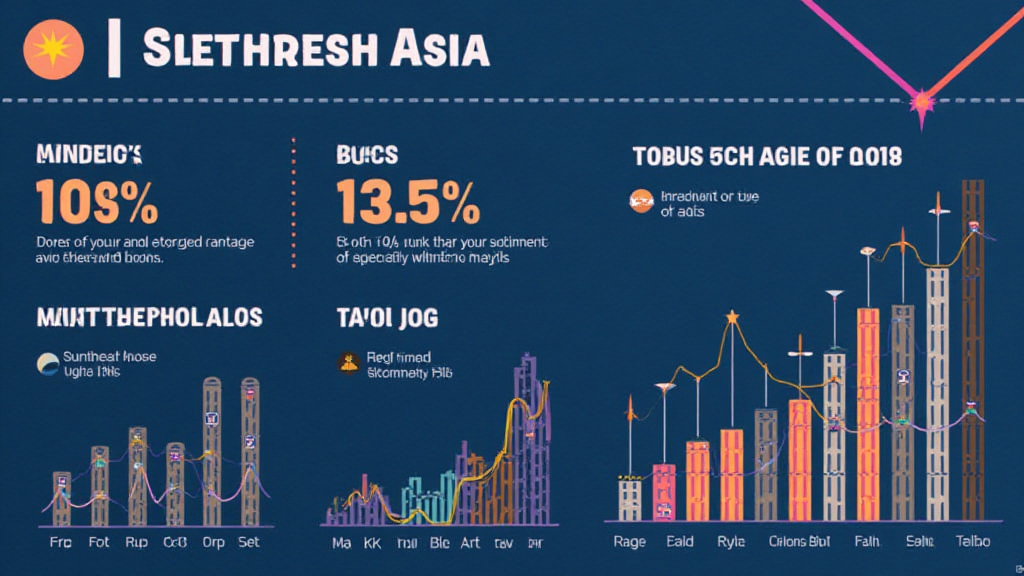

Southeast Asia Crypto Market Size: Navigating Opportunities in a Booming Sector

With the Southeast Asia crypto market experiencing exponential growth, stakeholders are eager to connect the dots regarding its size, potential, and future trajectory. Recent data suggests that in 2023 alone, the market has reached a valuation of approximately $12 billion, showcasing significant increases year-over-year. As the demand for cryptocurrencies surges, it becomes essential to explore various factors driving this market, including regulatory environments, technological advancements, and investor sentiment.

1. The Current Landscape of the Southeast Asia Crypto Market

To fully appreciate the landscape of the Southeast Asia crypto market size, it is vital to analyze several market drivers:

- Increased adoption of digital payment systems.

- Growth in smartphone penetration, especially in countries like Vietnam.

- Rapidly evolving blockchain technologies and platforms.

- Expanding investment opportunities in decentralized finance (DeFi) and non-fungible tokens (NFTs).

In Vietnam alone, the growth rate of cryptocurrency users has surged to 67% in the last year, which is indicative of a broader trend across the region.

1.1 Key Players in the Market

Several companies are leading the charge in the Southeast Asia crypto market. Notable exchanges like Binance and local platforms such as Hibt.com are adapting swiftly to market demands. Moreover, the influx of venture capital into crypto startups is promising for innovation and competition in this vibrant space.

2. Regulatory Framework Impacting the Market

As the crypto market evolves, regulatory frameworks are altering landscapes significantly. Countries in Southeast Asia are approaching regulation in various ways. For example:

- Singapore: The Monetary Authority of Singapore (MAS) has established clear guidelines for crypto operations, promoting a stable business environment.

- Vietnam: The government aims to regulate cryptocurrencies under the tiêu chuẩn an ninh blockchain initiative, promoting safe transactions.

- Malaysia: Launched its Digital Asset Regulatory Framework, ensuring investor protection and market credibility.

This regulatory clarity is a crucial factor contributing to the growth of the market size and investment enthusiasm.

3. Opportunities in the Market

The Southeast Asia crypto market is rife with opportunities, particularly in areas such as:

- Decentralized Finance (DeFi): With the total value locked in DeFi protocols growing, Southeast Asian users are eager to explore lending, borrowing, and earning yields.

- Non-Fungible Tokens (NFTs): Creative sectors, including arts and gaming, present immense potential for NFT expansion.

- Blockchain Innovations: New technological solutions (like Layer 2 scaling) are improving transactional efficiency, attracting more users.

By 2025, projections estimate that the market will have the potential to surpass $40 billion, signifying a compound annual growth rate (CAGR) of over 30%.

3.1 Future Trends to Watch

As we look toward the future, several trends are expected to shape the Southeast Asia crypto market:

- Greater integration of crypto with traditional finance.

- Advancement in regulations leading to institutional adoption.

- Increased focus on sustainable cryptocurrencies and energy-efficient technologies.

4. Navigating Risks in the Market

While the Southeast Asia crypto market is booming, it is also essential to recognize potential risks, including:

- Market Volatility: The inherent volatility of cryptocurrencies presents challenges for investors.

- Regulatory Risks: Shifting regulations could affect market dynamics.

- Security Concerns: With scams and hacks reported frequently, user education and security measures remain a priority.

Ultimately, potential investors and participants should conduct thorough due diligence and stay updated on the market dynamics.

5. Conclusion: The Future of the Southeast Asia Crypto Market

The Southeast Asia crypto market size illustrates a promising and vibrant future for investors and participants alike. As more users engage with cryptocurrencies, the importance of a supportive regulatory framework, sustainable practices, and heightened security protocols cannot be overstated. Stakeholders must remain vigilant and informed to navigate this evolving landscape effectively.

The exciting journey of the Southeast Asia crypto market is bound to present numerous opportunities. As we advance towards 2025, the integration of cryptocurrencies into everyday life signals a transformative era. Be prepared to harness the potential of this market, ensuring to follow trends and regulations for the best possible outcomes.

Yucoindustrial remains at the forefront of crypto developments, ensuring the latest insights and opportunities are highlighted for stakeholders. We look forward to navigating this exciting space together!

Written by Dr. Alex Finley, a recognized authority in blockchain technology, having published over 10 papers on cryptocurrency regulations and audited several renowned projects.