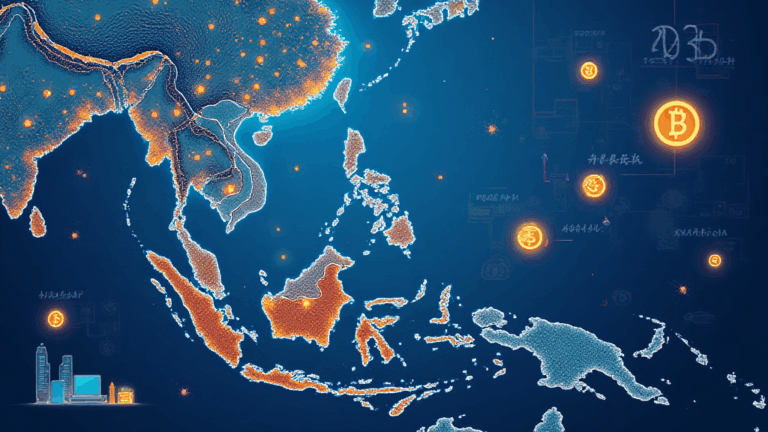

SEA Crypto Market Trends Forecast 2026: What Lies Ahead

As we embark on the journey towards 2026, the Southeast Asian (SEA) crypto market stands at a critical juncture. With an astonishing $4.1 billion lost to DeFi hacks in 2024, stakeholders are more critical than ever in understanding the evolving landscape of cryptocurrency and blockchain technology. By analyzing prevailing trends, regulatory frameworks, and user adoption metrics, we aim to provide a comprehensive forecast for the SEA crypto market in 2026.

Understanding the Current Landscape

The SEA region, particularly in countries like Vietnam, Thailand, and Indonesia, has seen a rapid increase in cryptocurrency adoption. Recent statistics indicate that Vietnam experienced a 35% growth in crypto users in just one year, reflecting a growing interest in digital assets.

- Regulatory Environment: With the increasing scrutiny from local governments, understanding compliance requirements becomes critical. Local regulations, such as tiêu chuẩn an ninh blockchain, are shaping the investment landscape.

- Investment Trends: In 2025, analysts predict that niche altcoins could outperform dominant players, with potentially lucrative opportunities arising.

Emerging Trends in SEA Crypto Market

As we look ahead, a few trends are poised to dominate the SEA crypto market in 2026.

1. Greater Institutional Adoption

Institutions are increasingly eyeing cryptocurrency, especially in regions like SEA. Banks and financial institutions are creating crypto-friendly policies, which will likely enhance investor confidence.

2. Enhanced Regulatory Frameworks

With an uptick in fraud and scams, regulatory bodies in SEA are tightening their grip on the industry. Compliance with tiêu chuẩn an ninh blockchain will be paramount for crypto businesses to gain public trust.

Key Opportunities in 2026

The growth of the SEA crypto market presents various opportunities for investors and businesses alike.

- Niche Altcoins: Identifying the 2025年最具潜力的山寨币 can yield profitable returns.

- Smart Contract Audits: Businesses will require expertise on how to audit smart contracts to minimize risks.

Challenges and Risks Ahead

While opportunities abound, challenges remain. Regulatory compliance, market volatility, and security risks need to be addressed proactively.

1. Security Risks

The increase in DeFi-related hacks underscores the necessity for robust security measures. Tools like the Ledger Nano X can significantly reduce risks by offering enhanced asset protection.

2. Market Volatility

Investors must prepare for a landscape characterized by fluctuations. Keeping abreast of market trends will be essential.

Conclusion: Preparing for the Future

As we look forward to 2026, the SEA crypto market holds significant promise, albeit with challenges. By staying informed and adopting best practices, stakeholders can navigate this evolving landscape successfully.

For more insights, check out hibt.com for in-depth articles on crypto compliance and innovation.

This analysis serves as a guide for anyone invested in or curious about the SEA crypto landscape. Not financial advice. Consult local regulators.

In summary, as the industry evolves, so too must our approaches to investing and regulation. Emphasizing security, staying compliant, and leveraging emerging technologies will be critical strategies as we look to 2026.

Author: Dr. Matthew Zhang, a seasoned crypto consultant with over 20 publications in blockchain and a leading auditor for several renowned projects.